Table of Content

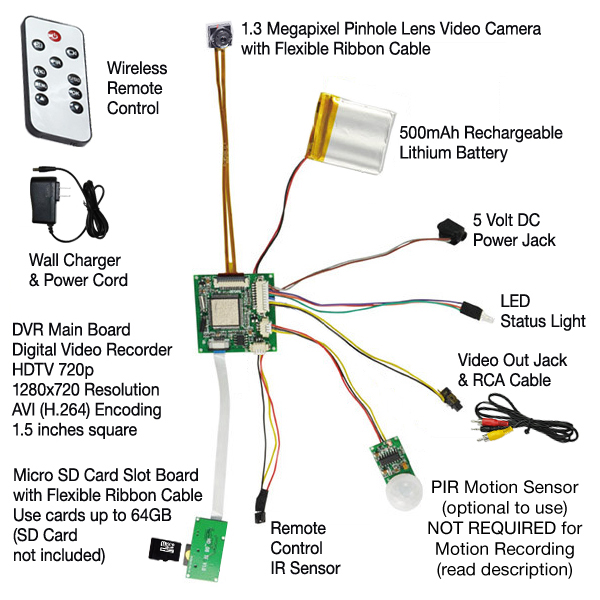

Attach the four wires to the board in the gold-colored areas. This is another thing that is crucial for a spy agent to have. Spy agent needs to go to the places and locations where normal people cannot go for research. Usually, children are found in collecting evidence. This is a super easy fingerprint kit that can be used to examine fingerprints. Whether they are small or large they sometimes feel beyond your reach.

It is a no big deal to make your own fingerprint kit at home. The things that you will need are cornstarch, one of mommy’s makeup brush, some black chalk, and scotch tape. Plugin your new spy camera to computer and make sure that it works. Position the camera wherever it will look most natural, either on the floor, or next to the leg of a table etc. Now you have made your own spy camera, you need to test whether it work well.

How To Use A Spy Pen Camera

Also, the camera features can make it easy to take pictures of things like receipts, items, and much more. You can plug your device directly into your computer to access the files that you have stored. All you have to do is plug it directly into the device and then select the option to view your files. From there, you can choose to erase files, or view them. To turn on the pen, you need to push the on/off button on the top of the pen.

You can use your old stuffed animal into spy gadgets. Most children have teddy bears; you can carry your favorite teddy as your spy partner. Welcome to SpyCentre Surveillance Equipment online store! Our online spy store allows us to serve customers anywhere in the country.

The recording book:

The first thing that you need to do is to insert the miniature battery into the small end of the camera lens part. It may require some effort as there is no space for you to hold on to the battery while inserting it into its slot inside the lens unit. Next, we will be soldering wires to connect the camera with the power switch and battery holder. You can use any color of wire you want as it does not matter in this step. Just make sure you know which wire is connected where because you will need to solder them back on when it’s done being assembled. There are many kinds of micro digital cameras available in the market and at very cheap prices.

And while you might be inclined to get one of those pens that have seven or eight colors because they’re rather thick – don’t. It’s something that’s immediately obvious, and people will figure it out rather quickly. One that houses a slightly thicker refill inside is perfect because it gives you a bit more space. Although, kids can also make these spy gear at home easily if they follow the all upper given instructions carefully. Hence, if you follow the instruction of how to make easy spy things easy then you can save your money as compared to market prices.

Putting the Kit Together

This is realistic for children who are inspired by their favorite heroes in action movies. If you have some thoughts and have the passion to get your inner ideas out then let’s jump into it. With a spy pen, you can record these interactions to ensure you and anyone you're with are protected if a complaint arises later. For customer-facing roles, a spy pen can be cheap insurance. Spy cameras are a great way to go if you like doing secret shopping. You can wear them to record everything in a shop, so you don't have to remember everything yourself.

Carefully remove the casing of the webcam and pull the lenses out along with the circuit board attached to it. Point the camera lens or the object towards the direction you want to keep an eye on. Purchasing a spy camera can be quite costly, and since you’ve bought one, you should also make sure it the best spy camera out there. But you can easily save some money by making a spy camera on your own.

Have you ever had to deal with someone who was just angry? Maybe you weren't quite sure how the experience would turn out, and being able to record things would have made it a whole lot better. Keep the small inside parts of the pen away from children, as they can pose a choking risk. You can refine the ideas we’ve covered and make them your own. It’s up to you to get creative and use a combination of ideas that would work for your kids. I’m sure there are a couple of ideas that have sprung into your mind while reading this.

With over 25 years of experience, SpyCentre Security is your premier spy gear store and security camera equipment provider. We also invite you to stop into our retail location near Dallas, Texas, located in the city of Plano. Our Plano location is well stocked with the latest technology, and every employee is carefully trained to help you maximize your protection.

We’ve covered some interesting ideas and DIY tips to get you started. We hope you’ve also come up with some of your ideas that’ll work perfectly for your kids. My favorite is the treasure hunt with invisible ink. I get them to use the binoculars and corner mirror to find the notes around the house.

This will make the camera considerably smaller, and thus much easier to hide. This is how you can make your spy gadgets at your home. Some of you have the abilities to be a spy but you are all thinking to get gadgets that are used to complete a mission. Here I have told you about all rather ways that how can you make spy gadgets. There are varieties of spy gadgets that can be purchased from the market.

Well, do not throw it away, from today that teddy can be your secret agent and keep you aware of what’s happening around. All you need is your not so favorite teddy, a webcam or any small camera, and a laptop. You have to carefully cut the cable to a finger size length. After cutting it, slice the plastic covering of the cord. You will see the wires in four different colors, take each wire and bend it downwards.

Leave the cotton portion of the Q-tip and about 5 millimetres (0.20 in) of the plastic handle out of the pen. Don't worry if the Q-tip is a little loose, simply hold it in place for now. It is important to use a pen with a metallic body, as this conducts the electrical charge from your hand which makes the stylus to work.